Which of the Following Is an Asset Utilization Ratio

Return on assets is a profitability ratio. Debt to total assets turnover.

Activity Ratio Formula And Turnover Efficiency Metrics

Asset utilization is a ratio used by business analysts to determine how well a company is using its available assets to generate a profit.

. You are called by a customer complaining that there computer is getting slower over time. Receivable turnover average collection period inventory turnover fixed asset turnover total asset turnover. Cability to pay short-term obligations on time.

The asset utilization ratio calculates the total revenue earned for every dollar of assets a company owns. Miller completed the following. Asked Aug 17 2019 in Business by khiarat.

Which of the following is not an asset utilization ratio. Multiple Choice quick ratio return on equity return on assets receivables turnover current ratio -are one of the primary external users of a. All of the following are asset utilization ratios except.

Aability to effectively employ its resources. A small inventory turnover means that the company stores. Debt to total assets turnover receivable turnover.

Any ratio with net income in the numerator is a. An increasing asset utilization means the company is being more. Fixed asset turnover D.

The calculation of asset utilization ratio involves four main metrics as well as several situational ones. Which of the following is not an asset utilization. A Increase current assets.

D Decreasing total liabilities. The key metrics involved in the calculation of asset utilization. In examining the debt utilization ratios the primary purpose is to measure.

A short-term creditor would be most. Which of the following is not an asset utilization. Terms in this set 15 The most rigorous test of a firms ability to pay its short-term obligations is its.

You check the CPU utilization and it varies between 95 and 100. Which two ratios are used in the DuPont system to create return on assetsAReturn on assets and asset turnover BProfit margin and asset turnover CReturn on total capital and the profit. Examination of assets management ratios shows how proficiently and successfully an organization utilizes its resources to produce income.

Asked Jan 29 2019. Dability to generate timely cash flows. C Fixed asset turnover.

Calculate this ratio using the following formula. B Decreasing current assets. Liquidity Ratios - the primary emphasis moves to the firms abilities to pay off.

Capacity utilization is defined by which of the following ratios. B Return on assets. The type of ratio that allows the analyst to measure the ability of the firm to earn an adequate return on sales total assets and invested capital is.

- for long-term assets the utilization ratio tells us how productive the fixed assets are in terms of generating sales. A plethora of diverse factors can affect the overall asset utilization in an organization. C Increasing current liabilities.

Chapter 03 - Financial Analysis 59. Which of the following are debt utilization ratios. All of the options are true.

School University of Hawaii West Oahu. D return on assets. Asset-utilization ratios are used to.

5 In trying to measure a companys effectiveness in earning an. Asset utilization ratios measure. Which of the following is not an asset utilization ratio.

They demonstrate the capacity of an. Ratio analysis can be useful for. -Which of the following is an asset utilization ratio.

Return on assets C. Which of the following is not an asset utilization ratio A Inventory turnover B. Cost of goods sold can be found on a businesss income statement.

Asset utilization ratios include all the following except.

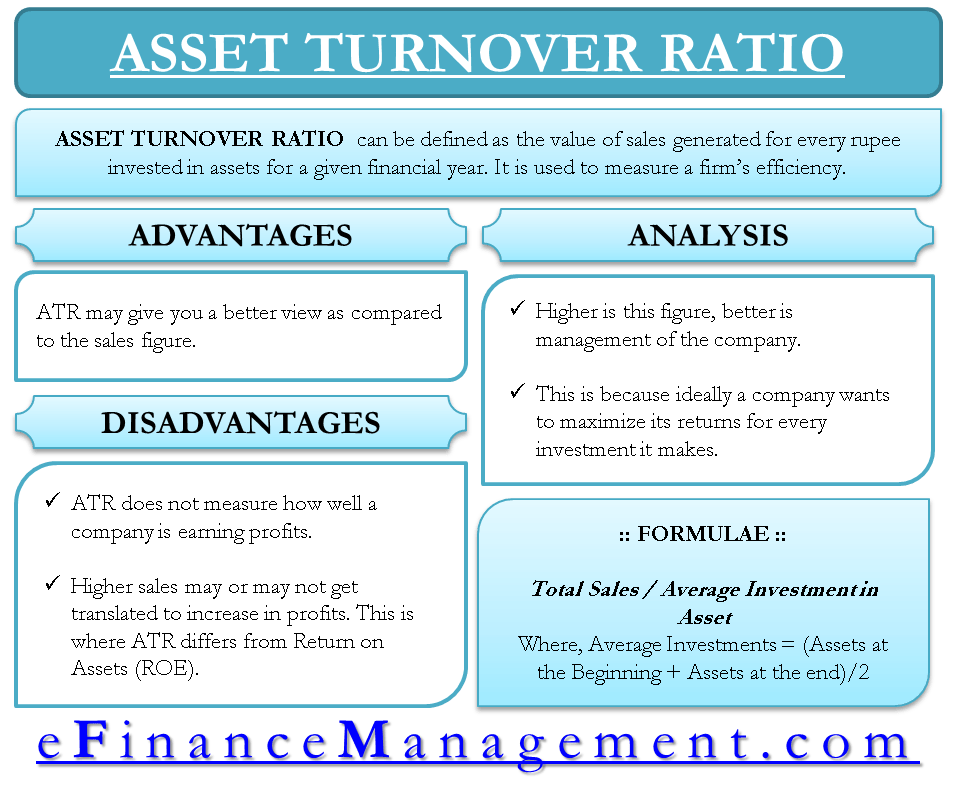

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

Asset Turnover Ratio Formula And Excel Calculator

No comments for "Which of the Following Is an Asset Utilization Ratio"

Post a Comment